Paris, June 8th 2021

C12 Quantum Electronics today announces the closing of a $10 million seed round comprising funds from 360 Capital, Bpifrance (Digital Venture Fund), Airbus Ventures, BNP Paribas Développement, and Octave Klaba (OVHcloud), with additional grants from Bpifrance and the Ile-de-France Region.

Founded in January 2020 by Matthieu and Pierre Desjardins, alongside scientists – Takis Kontos, a Research Director at CNRS, Matthieu Delbecq and Jérémie Viennot – C12 Quantum Electronics has crystallized a team of the world’s most accomplished experts in quantum electronics and carbon nanotube science to materialize their vision of a revolutionary quantum computing processor.

“This round will help accelerate the development of the company’s unique quantum computing technology. The groundbreaking innovation of C12 Quantum Electronics uniquely uses carbon nanotubes as the fundamental building blocks of its quantum processor. The company’s high-purity material minimizes errors and radically improves performance. Our quantum processor will have an unlimited range of applications, from optimizing transportation and logistics to transforming healthcare,” note the company’s twin founders Matthieu and Pierre Desjardins.

This funding will be used to expand its world-class team with cutting-edge tech developers and engineers, as well as establish a high-tech pilot production line, designed to include nanotube growth facilities, nano-assembly equipment, quantum measurement hardware, and more. Building upon the achievement of these first milestones, the startup aims to grow a range of quantum accelerators ready to be integrated into classical supercomputers, as well as design application-specific processors within the next five years, for example for optimization and quantum chemistry needs.

C12 Quantum Electronics’ Unique Technology

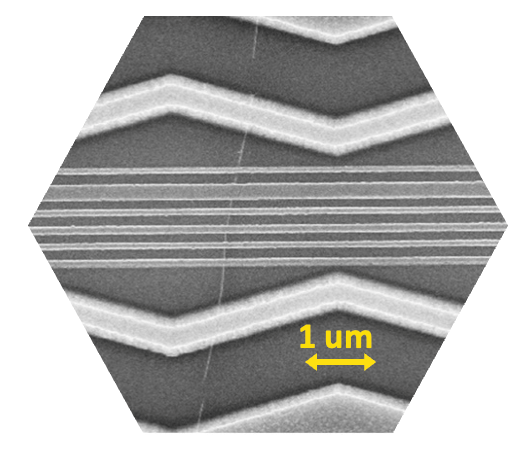

At C12 Quantum Electronics, a qubit, the fundamental functional unit of a quantum computer, is built from an ultra-pure carbon nanotube (the vertical line in the image), suspended above a silicon chip containing control electrodes and a quantum communication bus (the horizontal lines in the image). C12 Quantum Electronics’ carbon nanotubes are uniquely composed of isotopically purified 12C carbon atoms, which have zero nuclear spin, thus minimizing qubit decoherence.

“The quantum industry is still looking for the ‘ideal qubit,’ and there is a notable consensus across the scientific community that material science breakthroughs will be needed to build a scalable quantum computer,” explained Matthieu and Pierre Desjardins. “Carbon nanotubes will help scale quantum computing, in the vein of what silicon meant for classical computing. The continuing evolution of materials will help cultivate the emergence of this new industry,” they concluded.

Praise for C12 Quantum Electronics

“We believe C12 Quantum Electronics has a real chance to overcome the significant productization challenges that have held back the revolutionary promise of Quantum Computing” Nader Sabbaghian, General Partner of 360 Capital.

“Airbus Ventures is inspired by the C12 Quantum Electronics team’s extraordinary innovations. Our investments in their unique technology and in the field they are helping to pioneer with new materials holds wide and immense potential across the aerospace, sustainable aviation, and adjacent industry sectors. We expect even greater achievements ahead for Matthieu, Pierre and the team,” comments Airbus Ventures Partner Mathieu Costes.

“The quantum computer will answer some of the most challenging questions mankind is facing and that the binary computer cannot answer today. In this race for quantum innovation where, until now, no one has found solutions, we must continue to explore new ideas. C12 Quantum Electronics, a European startup, offers a different & very promising approach that needs to be explored and developed. I am very happy to give a helping hand to this brilliant team of researchers, already with a great entrepreneurial spirit,” Octave Klaba, Founder of OVHcloud.

“The quantum computer will be a major revolution and we are confident that C12 Quantum Electronics has unique strengths to play a leading role in it. We particularly appreciate the ambition and the quality of the founders as well as their ability to bring together key players. We are delighted to support C12 Quantum Electronics in this fundraising which constitutes an important step in the development of the company “, BNP Paribas Développement.

“We invested in C12 Quantum Electronics because we believe that the path to scalable QC lies in materials science breakthrough. We have been impressed by the team’s expertise, their ability to solve complex problems, and their keen understanding of what it takes to turn innovation into a promising business”, Olivier Rameil, Investment Director within the Digital Venture fund of Bpifrance.

About C12 Quantum Electronics

The start-up C12 Quantum Electronics develops reliable quantum processors to speed up highly complex computing tasks, thanks to a unique know-how developed at CNRS and the Physics Laboratory of the Ecole Normale Supérieure in Paris. The company is co-incubated at Agoranov and at PC’up of the Institut Pierre-Gilles de Gennes. To learn more about C12 Quantum Electronics, visit: www.c12qe.com

About 360 Capital

360 Capital is a Venture Capital firm investing in innovative deep-tech & digital enterprises across Europe. The firm has a 20-year track record of supporting talented tech entrepreneurs in developing ambitious & disruptive companies in a variety of sectors. Led by a diverse, and experienced team of professionals located in Paris and Milan, 360 Capital has over €400M of assets under management and an active portfolio of more than 50 companies. www.360cap.vc

About Bpifrance and the Digital Venture fund

Bpifrance’s equity investments are carried out by Bpifrance Investissement. Bpifrance finances companies – at every stage of their development – in credit, collateral and equity. Bpifrance supports them in their innovation projects and internationally. Bpifrance also ensures their export activity through a wide range of products. Consulting, university, networking and acceleration programs for start-ups, SMEs and ETIs are also part of the offer proposed to entrepreneurs. Thanks to Bpifrance and its 49 regional offices, entrepreneurs benefit from a close, unique and efficient contact to help them face their challenges.

Bpifrance Digital Venture is the VC team within Bpifrance, dedicated to digital and tech companies aiming to become global leaders on their market. It focuses on Seed and Series A/B stages. With €700 million under management, the team backed 90+ companies and had 18 exits since 2011. Amongst the investments made by Bpifrance Digital Venture team are Teads (bought by Altice), Talentsoft, Netatmo (Legrand), Meilleurs Agents (Axel Springer), Balyo, Manomano, Evaneos, Openclassrooms, Klaxoon, Livestorm, Shippeo.

About Airbus Ventures

Headquartered in Silicon Valley, with offices in Toulouse and Tokyo, Airbus Ventures is a fast-moving, early-stage venture capital company that independently funds and supports startups impacting the aerospace industry. Airbus Ventures has helped aspiring innovators reach new dimensions of achievement since 2015. To learn more, visit: https://airbusventures.vc.

About BNP Paribas Développement

BNP Paribas Développement, a BNP Paribas Group subsidiary founded in 1988, invests its own capital directly in promising small and medium-sized enterprises and mid-cap companies. As a minority shareholder in these target companies, BNP Paribas Développement seeks to promote their growth and ensure their longer-term prosperity by facilitating ownership transfer.

In 2016, BNP Paribas Développement set up the WAI Venture Fund, which specialises in investing in innovation-oriented companies, from the provision of seed capital through all subsequent funding rounds, with the aim of supporting the growth of high-potential startups.

www.bnpparibasdeveloppement.com

Informations complémentaires :

Laboratoire de Physique de L’École normale supérieure (LPENS, ENS Paris/CNRS/Sorbonne Université/Université de Paris)

Auteur correspondant : Pierre Desjardins